Payroll Calculator Template Microsoft Office

- Microsoft Payroll Template Excel

- Microsoft Payroll Calculator Template

- Excel Payroll Calculator Template

- Payroll Calculator Template Microsoft Office Excel

- Payroll Calculator Template Microsoft Office 2017

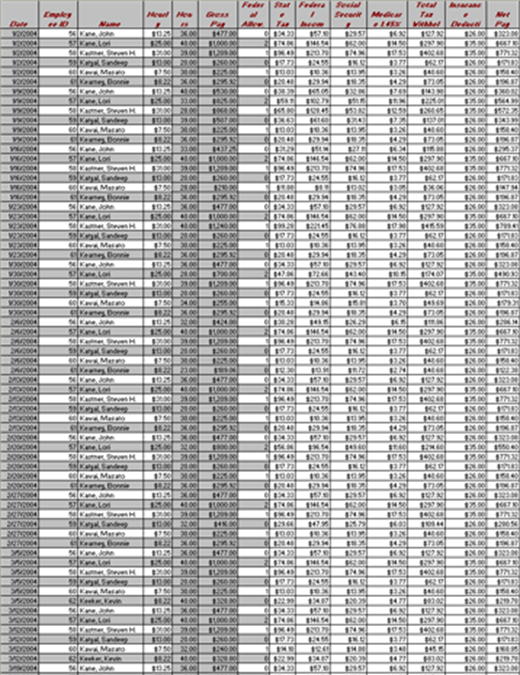

- Download Employee Payroll Calculator Templates. This Employee Payroll Calculator Templates is for microsoft office Excel 2013 or newer so you can have it under xls xlx or xltx extension. Employee Payroll Calculator Templates for ms excel file size is 25 kb.

- Category: Timesheet and Payroll. Download a trial version of Payroll Calculator for OpenOffice.org Calc. This version is limited to 5 employees only, otherwise it is fully functional. This calculator allows to create payroll for your employees and users percentage method as described in IRS Publication 15.

- With Excelling Payroll for Microsoft Excel you can: Have unlimited control - Take Control of your companies payroll tax deductions on Microsoft Excel instead of paying large sums to Accounting Softwares. Personalizable and Automated - Keep it simple by doing multiple employees tax deduction calculations all in the same place.

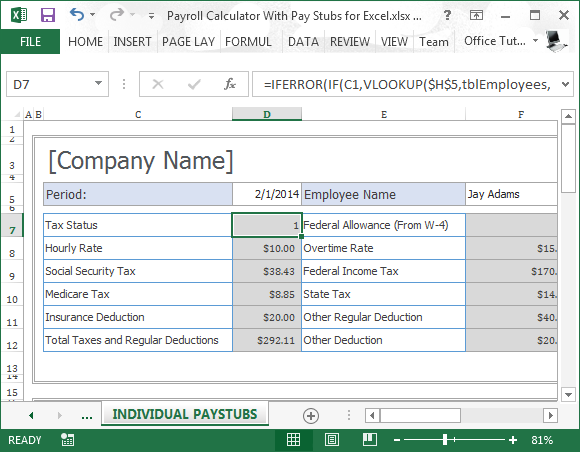

Since you are reporting worksite, drive/prep time, vacation and overtime hours each separately, it's fairly straight forward. Assuming your table is laid out with the word 'Period:' in cell A1, that puts Gross Pay at E7 and the amount for E7 at E8. Before you can create pay stubs for your employees, Microsoft Excel will calculate the employee’s gross and net pay. There is a payroll calculator page on the program where you are going to have to input the number of hours that the employee has worked, the number of hours the employee has rendered as overtime, and the number of times the employee has filed for sick leave.

From Sobolsoft:Microsoft Payroll Template Excel

What do you need to know about free software?

From Sobolsoft:Hi, I am very new to Excel and need to ask a basic question, please forgive my 'kindergarten/Preschool' ignorance:

Microsoft Payroll Calculator Template

I have a cleaning company. My employees are paid 2 different rates of pay, one for driving to job sites, meetings, prep time, etc., the other is actual work site pay. I don't know how to add this formula to total correctly-Can someone help me with this please. Thank you so much in advance!

Looks like this now: | ||||||

Period: | 10/12/2013 | Employee Name | Employee ID | 1 | ||

Tax Status | 2 | Federal Allowance (From W-4) | 2 | Hours Worked | 16.5 | |

Hourly Rate | $9.00 Disadvantages of pdf files. E-Book Formats and CompatibilitySome e-book stores and e-readers lock you in to a particular brand, making it possible to lose access to purchases if you change e-readers. Although a rare situation, the event highlights the difference in ownership from physical books. | Overtime Rate | $0.00 | Sick Hours | 0 | |

Social Security Tax | $9.21 | Federal Income Tax | $0.00 | Vacation Hours | 0 | |

Medicare Tax | $2.15 | State Tax | $9.00 | Overtime Hours | 0 | |

Insurance Deduction | $0.00 | Other Regular Deduction | $0.00 | Gross Pay | $148.50 | |

Total Taxes and Regular Deductions | $20.36 | Other Deduction | $0.00 | Total Taxes and Deductions | $11.36 | |

Net Pay | $128.14 | |||||

This is what I need it to look like:

Excel Payroll Calculator Template

Payroll Calculator Template Microsoft Office Excel

Period: | 10/12/2013 | Employee Name | Employee ID | 1 | |

Tax Status | 2 | Federal Allowance (From W-4) | 2 | Hours Work Site + | 16.5 |

Hourly Work Site Rate | $9.00 | Overtime Rate (affects this) | $0.00 | Hours Driven | 16.5 |

Social Security Tax Software lag switch. Hope you guys enjoy the video and don't forget to rate, comment, like, and subscribe peace!!Leader: Xbox 360 GT: Triple KickzRARLAB - Free Download link For WinRAR 4.11 or 4.20Link:Net tools 5 download Lag Switch:Link:UDP Unicorn download to Lag Switch:Link:'Copyright Disclaimer Under Section 107 of the Copyright Act 1976, allowance is made for 'fair use' for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Non-profit, educational or personal use tips the balance in favor of fair use.' Hey guys its Triple Kickz From HLGLegendary2 showing ya How to download, install, and use a wireless lag switch full tutorial. Fair use is a use permitted by copyright statute that might otherwise be infringing. | $9.21 | Federal Income Tax | $0.00 | Vacation Hours | 0 |

Medicare Tax | $2.15 | State Tax | $9.00 | Overtime Hours | 0 |

Hourly Drive Rate | $7.25 | Other Regular Deduction | $0.00 | Gross Pay | $148.50 |

Total Taxes and Regular Deductions | $27.61 | Other Deduction | $0.00 | Total Taxes and Deductions | $11.36 |

Net Pay | $128.14 |